This is a time of opportunity for many WA businesses. In winning new work, businesses can find themselves paying for products and services much quicker than their clients pay them. The faster you grow, the bigger the problem becomes. It puts severe strain on the business’s cashflow and it’s hard to grow.

Let’s use the example of a business supplying goods to their customers:

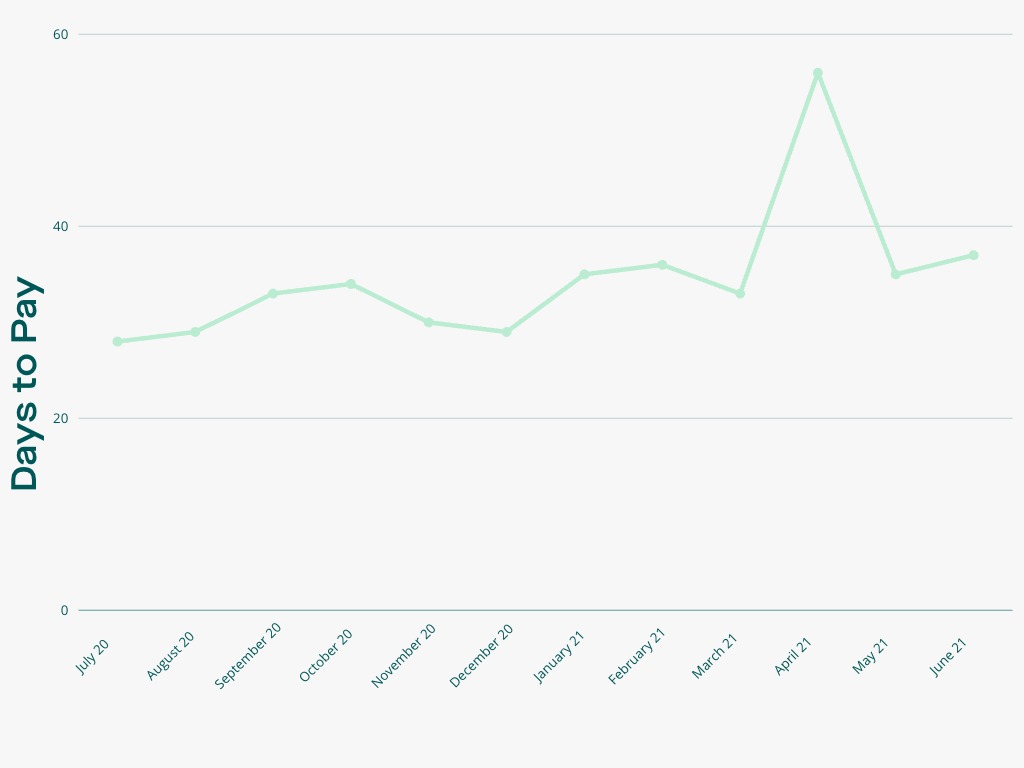

In the typical goods supply cycle, you’re paying the bulk of the costs associated with a sale well before you receive payment. You’ve got the costs of the goods, your internal labour costs and your overhead costs. You are seeing a lot of money go out before the last step – step 8 above – when your customer pays. Also, across all industries and business sizes, it is taking on average 37 days for your invoices to get paid, and that’s getting longer:

Faster growth only makes the problem worse. As you win new business, you’ve got even more money going out the door to support that new work. The capital requirements in your business will increase dramatically. Your business may grow faster than its ability to fund that growth.

For a business owner, there are business finance options available, including bank loans and overdrafts, non-bank finance and, in the worst case, delaying creditors.

One option is to make use of the assets in your business to secure a business finance solution. Often the best assets for this are your customer invoices. In invoice financing, you sell your invoices to the financier. This brings forward your cash inflows and provides working capital to fund existing and new work.

So, what’s the catch?

A traditional invoice financing facility will involve you selling all of your customer invoices, whether you want to or not. The facilities’ costs also tend to be expensive with complicated pricing. They commonly require security over all of your business’s assets and your personal guarantee.

We believe that the best business finance solution:

Thriver’s invoice financing solution provides all those things:

We work with you to understand your best quality customers and a facility limit that suits your needs. You sell only the invoices that you want to sell. When we buy an invoice, we pay you 80% of the invoice value, with the balance (net of fees) paid to you when the invoice is paid.

Thriver works with high quality businesses with strong customers. Because of that, we don’t need additional security from your business or from you. We price our facilities fairly and transparently, meaning that you always know the cost of your financing and can build that into your cash flows.

Return Home

See all articles.