In the midst of Covid in 2020, WA’s economy contracted just 0.2% as many advanced economies contracted by more than 10%. The WA Government forecast the economy to grow 2.0% in the last financial year and a further 2.75% this year. A number of commentators have put that expected growth closer to 5%, along with a record budget surplus driven by iron ore and other mineral royalty payments. With borders effectively closed to foreign workers, the unemployment rate has fallen below 5% and job vacancies, skills shortages and some wages are rising.

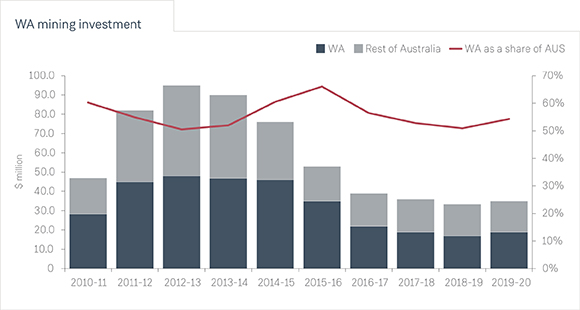

The Department of Mines, Industry and Regulation says, at September 2020, there were resources projects in the development pipeline valued at $129 billion with $28 billion already under construction or committed. This followed $19 billion of investment in the mining sector in 2019-20, a record since the LNG boom in 2012-13:

For many WA businesses, this is a time of opportunity. CCIWA’ Business Confidence Survey has shown confidence in the three-month outlook to be at the highest level since 2007. The Survey found 88% of businesses in the resources sector anticipate stronger economic conditions in the July quarter.

But in that opportunity, there is a major challenge. As businesses – particularly SMEs – win new work, their working capital needs grow. Business owners have to fund the costs associated with that additional work and often the requirement outstrips both cash flow and capital reserves.

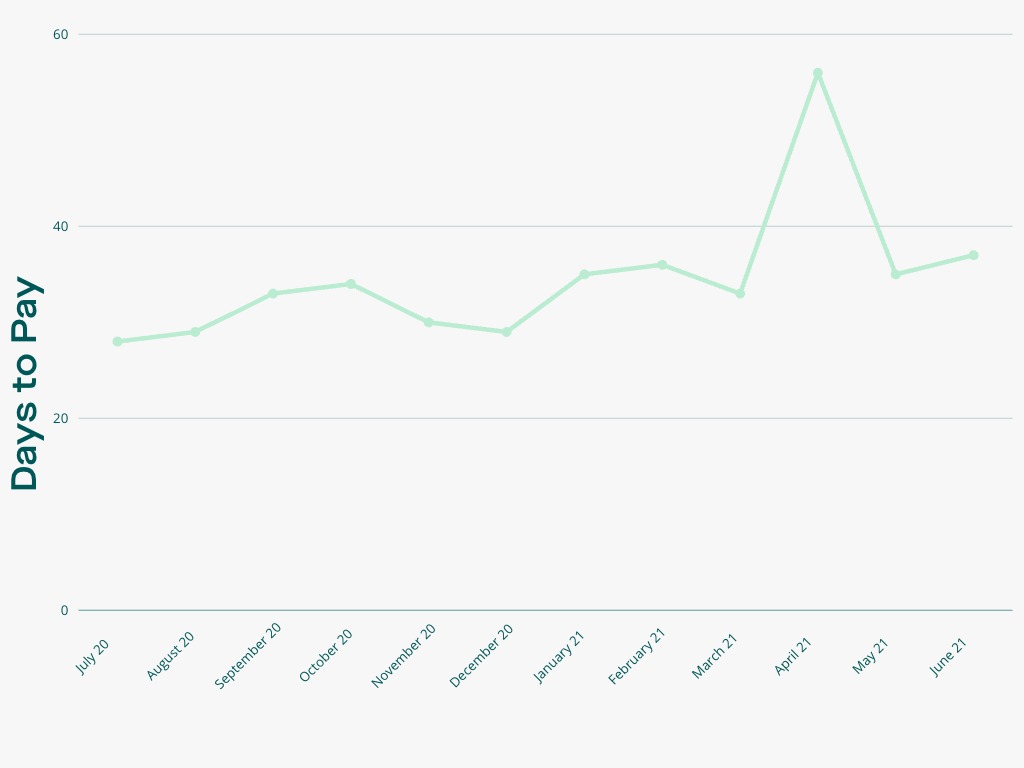

Across all industries and business sizes, it is taking longer for companies to pay their suppliers. Even excluding the Covid-related anomaly in April 2021, the trend is established. It will take on average 37 days for your invoices to get paid, and that’s getting longer.

When you combine opportunities for high growth with slower payment times, SMEs are being put in a capital squeeze and not being able to fund their growth.

Suppliers, staff and the ATO all need to be paid. Staff and suppliers in particular need to be paid before clients pay their invoices. This creates an ‘upside down’ cash flow cycle, with businesses in a perpetual cycle of outgoing cash flow.

As a business owner, there are some traditional business finance options open to you. In whole or part, they can help fund your business as it grows.

None of these options are appealing, they can also be very expensive and put your personal assets at risk.

As businesses – particularly SMEs – win new work, their working capital needs grow. Business owners have to fund the costs associated with that additional work and often the requirement outstrips both cash flow and capital reserves.

Many businesses have assets that can be used to secure a business finance solution.

Financing using these assets can allow your business to grow without the constraints of traditional finance options. One example is invoices owed by your clients. Another is unencumbered equipment.

The best business finance solution has the following characteristics:

Above all, a business owner should be able to work closely with their finance provider. You need a relationship with your finance provider. To have personal contact with the people making the decisions. People who don’t need to send the decision to ‘credit’ or elsewhere.

Return Home

See all articles.Next Article

Fix Your Upside Down Cash Flow