Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Small business and family enterprises or SMEs make up 99.8% of Australian businesses, representing $400 billion in debt that is growing at about 6% a year. There are 170,000 SMEs with revenue of at least $2 million that need money to grow further.

What are the options for SMEs in the debt market? The Productivity Commission released a report in late 2021 that examines how SMEs access debt finance in Australia.

The PC report found that:

The PC further found that, in 2018-2019, SMEs sought debt from:

We’ve talked previously about the challenges for SMEs in getting bank debt. You can read back here. The RBA reports that the largest non-bank growth has been balance sheet lending by technology firms (fintechs) that, “use transaction data to identify creditworthy business borrowers and provide loans and trade credit from their own balance sheets. This makes the application process quicker and easier … [h]owever, interest rates on these loans tend to be much higher than on bank loans. Additionally, small businesses can typically only access small loan amounts through these lenders (generally up to $250,000), which is a limitation of this source of funding”. Further options are private credit funds and different types of finance, for example, asset finance.

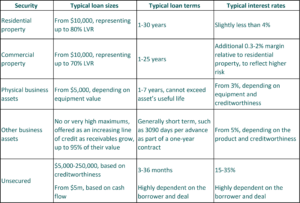

The PC report summarised the lending products available to SMEs seeking finance, based on the type of security:

We observe that the PC report’s assessment of typical interest rates appear low. Real world examples for SMEs seeking $250,000 to $1 million in debt show pricing in the double digits and above.

Next time, we’ll look at why SME debt can be an attractive investment.

Return Home

See all articles.Previous Article

Why is it hard for SMEs to get money?Next Article

Why is SME debt an attractive investment?