Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Borrowing by SMEs represents $400 billion in debt that is growing at 6% a year. There are 170,000 SMEs who have at least $2 million in revenue and need money to grow further. Using investment syndicates, Thriver provides those SMEs with innovative, well-thought-out solutions with quick turnaround for funding needs of $250,000 to $1 million.

In recent notes, we’ve discussed return OF capital and return ON capital for investors. An important element of both is risk mitigation. A valuable risk mitigation tool is establishing and building relationships.

Traditional business banking – long since gone – was built on relationships. Ongoing relationships between the SME and the lender that developed over time. Open and direct conversations about the opportunities and challenges for the business and how the lender could assist whilst still protecting their investment.

A relationship-based approach is critical to generating returns and mitigating risks for our investors. We start building relationships immediately. Our first step with a client is assessing their finances, their business and their risks. We identify opportunities and threats. We set this all out for our client. We provide a baseline for SME owners to understand the needs of their businesses to grow. It gives them certainty. It also enables us to build an actionable funding plan for them, which is the next phase of the relationship.

That funding plan sets out ideal funding structures and what the clients should do with the funding to grow their business. A big element is communication, particularly of any ‘bad’ news. Communication is easier with a strong relationship. If we know the news – good or bad – we can help shape solutions. Our ability to keep an open channel gives our clients confidence.

Once funding is in place, our relationship continues. It’s a structured and ongoing process. We sit down with our clients and assess performance and identify new and changing risks. We regularly meet with our clients to assess performance, identify new and changing risks, and explore opportunities for additional funding as their businesses expand. Where possible, we strive to reduce overall costs.

Our clients find reassurance in knowing that they have a partner in the trenches, committed to supporting them through the challenges and triumphs of growth. This partnership provides comfort, and our proximity to their business positions us well to identify threats and help overcome them, safeguarding our investors’ capital.

Our next newsletter looks at other risk mitigants. Look forward to being in your inbox then.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Borrowing by SMEs represents $400 billion in debt that is growing at 6% a year. There are 170,000 SMEs who have at least $2 million in revenue and need money to grow further. Using investment syndicates, Thriver provides those SMEs with innovative, well-thought-out solutions with quick turnaround for funding needs of $250,000 to $1 million.

Last time, we talked about our investors wanting return OF their capital, ie, getting their money back. This week, it’s about making them money through return ON capital.

A Thriver facility comprises fees associated with the establishment and operation of that facility and an interest element on the funding provided. How the facility operates varies depending on the structure used for funding. But in broad terms, there will be those components of fees and interest.

The return to investors is driven by the interest charged under a facility, which we can call Y%. The return to investors is X%, being Y% less the Net Interest Margin that is Thriver’s share of the interest charged.

Many of our investors look at a prospective syndicate investment in light of four factors: pricing; collateral; tenor and size. Tenor is the length of the investment. Size is how big is the investment. Collateral is the value of any security. Pricing is the investor’s intended return or X%. Investors have different views as to the mix of those four factors that makes an investment suitable for them. In marketing each syndicate, Thriver outlines the four factors, including pricing, giving investors the ability to select investments that meet their requirements.

We price each facility to reflect the specific transaction. Typically, X% – the intended return for investors – falls between 8-14%.

The subject of our next newsletter is the importance of relationships. Look forward to being back in your inbox then.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Borrowing by SMEs represents $400 billion in debt that is growing at 6% a year. There are 170,000 SMEs who have at least $2 million in revenue and need money to grow further. Using investment syndicates, Thriver provides those SMEs with innovative, well-thought-out solutions with quick turnaround for funding needs of $250,000 to $1 million.

Our investors want the return OF their capital and a return ON their capital, in that order. That is, they want their money back when a facility ends even more than they want to earn a return on that money. As one investor told us, “We’re not risk averse, but we are loss averse”.

Identifying and mitigating risks to the return of capital is both a front end and ongoing process. We use a quantitative and qualitative assessment to clarify a business’s financial performance today, its obstacles to growth and key risks to the business. That assessment provides SME owners with great insights into their business. More importantly, it helps us exclude deals that put return of capital in doubt.

The prospective client is critical in this assessment. A Thriver client is a real business: a profitable business with growing revenue. The owners are smart, serious, committed businesspeople. They understand both the opportunities in the business and the risks. Those business risks are, in turn, risks to the return of capital.

If we determine that a client and opportunity are appropriate, the next step is to build a plan for that client. That plan sets out funding options, solutions to growth obstacles, milestones for the 12 months post funding and mitigants to risk.

Once funding is in place, Thriver continues to work with its clients, building relationships and mitigating risks. Because we deal with growing businesses, clients frequently seek to increase the size of their facility over time. We work with our clients on growth plans up to our $1 million limit. At each stage we make the same initial assessment of risks to return of capital and, where we increase a facility, work closely with clients to mitigate those risks.

After return of capital, comes return on capital. How investors can make money from SME debt is the subject of our next newsletter.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Borrowing by SMEs represents $400 billion in debt that is growing at 6% a year. There are 170,000 SMEs who have at least $2 million in revenue and need money to grow further.

Last time, we looked at why SME owners prefer to borrow debt rather than source equity. In simple terms, they don’t give up ownership, they retain decision-making control and debt is more readily available than equity.

The other important impact of debt is its effect on an SME’s profitability. There are a couple of elements to this. Firstly, when you have debt, you pay interest, fees and costs. Those payments are typically tax deductible. The deduction provides a partial shield against tax on earnings. In an SME, the impact of that shield is usually ‘nice to have’ rather than transformative.

The more significant impact is how debt improves an SME owner’s return on their business investment, compared to equity investment and funding everything themselves.

Let’s run through a quick example.

A business needs $100 of investment to generate $10 in profit. If the SME owner invests that $100, the return on their investment is 10% ($10/$100).

If the owner invests $80 and borrows $20 of debt, their return increases to 12.5% ($10/$80). That is a 25% increase in their return. There are few decisions a business owner can make that increase return by 25%.

If the owner invests $80 and an equity investor $20, the equity investor gets their 20% share of the profit ($2) and the owner’s return goes back to 10% ($8/$80).

That’s basic analysis but you get the picture: the business owner can use debt to massively increase the profitability of their business investment AND have $20 to invest elsewhere.

Of course, the example relies on the SME owner using debt that is appropriate for their business and cost effective such that it doesn’t eat into the $10 profit. This is Thriver’s space. We provide innovative, well-thought-out solutions with quick turnaround for funding needs of $250,000 to $1 million. We understand how the right debt solution can meaningfully impact on the owners of SMEs.

Next time, we’ll look at the importance of return of capital.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Small business and family enterprises or SMEs represent $400 billion in debt, growing at 6% a year. There are 170,000 SMEs with revenue of at least $2 million that need money to grow further.

Relatively few business owners can sustain the capital needed for $2 million of revenue and above. If you have reached the limits of your personal balance sheet, you need to look externally. The two basic choices are debt and equity finance. According to the Productivity Commission, on 2018-2019 data, 25% of SMEs with turnover of $2-10 million applied for debt finance; yet only 6% of all SMEs sought equity finance. One can describe the preference for debt over equity as ‘the necessity of debt’.

Economic theory says that SMEs, lenders and investors will often prefer debt to equity, for a number of reasons. With debt, an SME owner retains ownership and control of their business. They are the sole beneficiary of their decisions and actions. There is no incentive misalignment between the SME and the lender. The relationship is simple: the SME borrows from and must repay the money to the lender.

In contrast, equity investment can result in serious misalignment between the parties. An investor may see their capital deployed towards objectives other than maximising profit, such as investing in growth or an owner inflating their salary. An SME owner may see attempts by investors to control decision making – along with their ownership being diluted – as being too high a price to pay. The perception of interference is a classic misalignment.

The necessity of debt has another aspect. For most SMEs, debt is more readily available on ‘reasonable’ terms than equity. Debt markets provide liquidity – the money that enables businesses to function and grow. Often, the lenders will reduce the cost of debt by over collateralising. That is, they can offer a lower price because there is lots of asset security if something goes wrong. An equity investor doesn’t have that option. Their investment is by its nature ‘at risk’ and they are incentivised to determine the ‘right’ price to pay for their investment. An equity investor’s assessment of that ‘right’ price and their resulting percentage of ownership will often be at odds with those of the SME owner.

That’s not to suggest that debt lenders are less cautious than equity investors. It is just that lenders have different mechanisms available to them. Those mechanisms, with appropriate investigation and understanding of an SME, can result in more cost-effective solutions.

This is Thriver’s space. We provide innovative, well-thought-out solutions with quick turnaround for funding needs of $250,000 to $1 million. We understand their changing requirements and work quickly to get funding in place.

Next time, we’ll look at the benefit of debt.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Borrowing by SMEs represents $400 billion in debt that is growing at 6% a year. There are 170,000 SMEs who have at least $2 million in revenue and need money to grow further.

So, how do SME owners look at debt?

Our friends at the Productivity Commission had a look. They estimated that, in 2018-2019, about 25% of SMEs who turnover more than $2 million applied for debt. That’s higher than the overall average of 15%, reflecting that owners of bigger SMEs often don’t personally have the money needed to fund growth.

The PC’s stats back that up: the most common reason for applying for debt (47%) was to maintain short-term cash flow or liquidity. Replacing or upgrading equipment – machinery, IT gear etc – came in second at 41%.

Digging into 2017-2018 numbers, the PC found that 47% applied for short-term products – credit cards, overdrafts, loans, lines of credit – with terms of 1 year or less. This reflects that:

If an owner has built a business to $2 million turnover, they are a smart, serious and committed businessperson. They’re good at what they do. They know that they need outside money to keep growing. But many of these smart people don’t know their options and are apprehensive about assessing them. It is literally outside their comfort zones. Too often, they choose a ‘solution’ without evaluating alternatives and the consequences of their choices.

Those consequences can snowball to the point that the cost of debt can threaten the profitability of the business. It is unsustainable and frustrating for the SME owner.

Thriver provides innovative, well-thought-out, fairly-priced finance solutions with quick turnaround for businesses needing between $250,000 to $1 million of debt. We understand that smart business owners want someone who can recognise their changing requirements and work quickly to get funding in place.

Next time, we’ll look at the necessity of debt.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Small business and family enterprises or SMEs represent $400 billion in debt, growing at 6% a year. There are 170,000 SMEs with revenue of at least $2 million that need money to grow

further.

SME funding needs and options change as they grow. We call the progression ‘Fintech to Thriver to Banks’.

Newer SMEs’ funding needs can be sporadic and short term. They can be reliant on a major customer, where a delay in payment can lead to a short-term funding shortfall. The SME knows the client will pay but they’ve missed the customer payrun. An SME might go to a fintech or private lender to cover a shortfall of $10,000-$25,000. It’s expensive, but it’s only for a few weeks at a time, so it’s an enticing solution.

However, as the business grows, SMEs find themselves going back to the lender more frequently and for larger amounts, up to $200,000. At that stage , the ever-increasing amount of fintech or private lender debt can start to get so expensive that it affects the SME’s profitability.

Alternatively, the SME business owner may have scraped by, avoiding the fintech and private lender market. However, they have reached the point that they can no longer use their own reserves to fund growth. SMEs like that:

They often need more money ($250,000 and up) and may have limited appetite for a fintech’s pricing model. Yet they are still too small for banks to commit time and resources to understanding their needs. Even if a bank is eager to deal with the SME, a lengthy credit approval and onboarding process might mean the SME misses the opportunity.

This is Thriver’s space.

We provide innovative, well-thought-out solutions with quick turnaround for funding needs of $250,000 to $1 million. We provide the funding support growing SMEs need at a price that won’t cripple their businesses. We understand the changing requirements of SMEs and work quickly to get funding in place.

SMEs of this type are real businesses. They have growing revenue and they are profitable. They are owned and run by smart, serious, committed businesspeople. These owners understand they need external money to get access to growth opportunities.

Thriver limits its facilities to $1 million because that’s the natural progression point. The point at which banks should be getting interested. A $1 million facility is big enough for the bank to present a solution and get its wheels in motion. But because an SME has Thriver in place, they can afford to work to the bank’s timetable. Eventually, the bank’s process will come to an end. When it does, the SME will lower its funding costs again and can grow with the bank well past $1 million.

Next time, we’ll look at how SME owners view debt.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Small business and family enterprises or SMEs represent $400 billion in debt, growing at 6% a year. There are 170,000 SMEs with revenue of at least $2 million that need money to grow further.

Why is SME debt an attractive investment?

Thriver provides SMEs with syndicated debt facilities from $250,000 to $1 million. Below $250,000, there are bank and non-bank (fintech and private lender) options. Above $1 million, SMEs should be starting to attract the attention of banks.

The space is attractive because of the dynamics of the SMEs that need between $250,000 and $1 million. They typically:

These SMEs are real businesses. They have growing revenue and they are profitable. They are owned and run by smart, serious, committed businesspeople. These owners understand they need external money to get to access growth opportunities.

They often need more money ($250,000 and up) and have more business complexity than fintechs can assess. But they are still too small for banks to commit time and resources to understanding their needs.

For an investor, these SME debt facilities can provide a high return (often double digits) and the associated risks can be mitigated effectively. Structured as syndicates, investors have open and transparent understanding of who their money is going to and how it is being used. Syndicates and the matching facilities typically have a one-year term with options to renew for a further one or more years.

Banks still use the phrase ‘relationship management’. And that’s what traditional business banking was: an ongoing relationship between the SME and the lender that developed over time. Open and direct conversations about the opportunities and challenges for the business and how the lender could assist whilst still protecting their investment. Thriver takes that traditional approach to our syndicated SME debt facilities. We actively manage our facilities and build relationships to ensure investors:

Of course, no investment is risk free and Thriver syndicates are only available to sophisticated and other wholesale investors.

Next time, we’ll look at how SME debt facilities are priced.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Small business and family enterprises or SMEs make up 99.8% of Australian businesses, representing $400 billion in debt that is growing at about 6% a year. There are 170,000 SMEs with revenue of at least $2 million that need money to grow further.

What are the options for SMEs in the debt market? The Productivity Commission released a report in late 2021 that examines how SMEs access debt finance in Australia.

The PC report found that:

The PC further found that, in 2018-2019, SMEs sought debt from:

We’ve talked previously about the challenges for SMEs in getting bank debt. You can read back here. The RBA reports that the largest non-bank growth has been balance sheet lending by technology firms (fintechs) that, “use transaction data to identify creditworthy business borrowers and provide loans and trade credit from their own balance sheets. This makes the application process quicker and easier … [h]owever, interest rates on these loans tend to be much higher than on bank loans. Additionally, small businesses can typically only access small loan amounts through these lenders (generally up to $250,000), which is a limitation of this source of funding”. Further options are private credit funds and different types of finance, for example, asset finance.

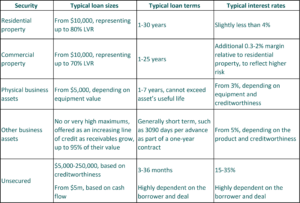

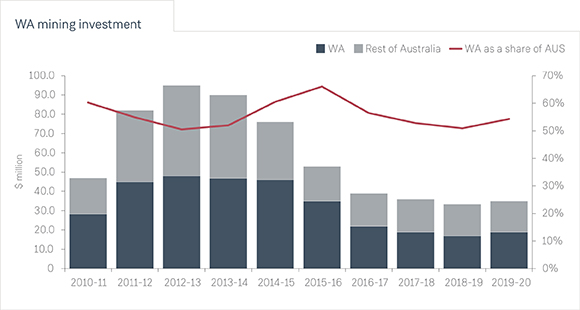

The PC report summarised the lending products available to SMEs seeking finance, based on the type of security:

We observe that the PC report’s assessment of typical interest rates appear low. Real world examples for SMEs seeking $250,000 to $1 million in debt show pricing in the double digits and above.

Next time, we’ll look at why SME debt can be an attractive investment.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

SMEs (or small business and family enterprises) are a big deal in Australia, making up 99.8% of businesses. RBA data shows that, across decades, obtaining finance from banks has been a challenge for small business. Why?

Traditionally, a business owner would go to their local bank manager to discuss their needs for money to grow. The bank manager – backed by the credit department and lending criteria – would assess the plans and decide whether to lend the business owner money.

The globalisation of bank funding, the Basel banking rules, and the way banks operate have all changed. Banks are often disincentivised from lending to SMEs. Unless a business is big enough and needs enough money, banks will not prioritise an SMEs’ needs.

Banks also run processes that don’t always need to make it easy for SMEs to access funding:

“[Small businesses] often face a number of other non-price barriers to accessing financing … The approval process is often difficult and can be relatively costly for small businesses … As a result, some small businesses on the panel reported that they had given up on seeking finance from banks.” (RBA)

Here is a real-world example from a former Thriver client:

A growing, decade-old business that always had its accounts with a Big Four bank who wouldn’t fund their working capital needs. They came to Thriver. In the last few years, we funded them and, when they grew past our $1 million limit, they rolled their facility to another non-bank lender. A few months ago, their bank noticed how much they’d grown. The bank created a product to suit the business’s needs. Why? Because the business had grown enough for it to be the right fit for that bank’s offering. Same business, same people, just bigger.

The RBA also reports that, “to reduce non-price barriers to accessing finance, a number of traditional lenders are increasingly automating processes for small business lending… Some banks are implementing digital lending platforms to simplify the application process and reduce processing times for small business customers. These sorts of platforms generally utilise customer data, such as historical transactional and accounting data, to automate credit decisions up to a certain amount (typically up to around $200,000).”

In other words, banks are starting to duplicate aspects of the fintech model for $200,000-250,000 facility limits. Fintech facilities can, in certain circumstances, charge SMEs interest rates up to 40% per annum.

So, where does this leave the bulk of the 170,000 SMEs turning over more than $2 million? Or businesses that need more than $200,000 but not enough to interest the banks?

Between a rock and hard place.

Next time, we’ll look at the options available for SME debt.

Welcome to Thriver’s short reads about investing in SME debt and how the SME debt market works. You’ll read them faster than you finish your cup of coffee.

Small business and family enterprises or SMEs are a big deal in Australia.

ABS stats from June 2022 show that Small and Medium Sized businesses (SMEs) up to 200 employees make up 99.8% of businesses in Australia.

SMEs who have achieved at least $2million in revenue present a market opportunity of 170,000 businesses. At that size, they are often presented with growth opportunities and need money to seize these opportunities. We support those businesses by providing debt facilities between $250,000 and $1 million.

We fund each deal through syndicates of investors who see the opportunity in SME debt. Thriver actively manages its SME debt facilities to ensure investors:

Of course, no investment is risk free and Thriver syndicates are only available to sophisticated and other wholesale investors.

So, let’s talk more about the size of the SME debt market.

RBA data from September 2022 showed SME lending of more than $400 billion, with lending up 6% year on year. Each year, the RBA convenes a Small Business Finance Advisory panel to better understand small businesses’ challenges. In 2022, panelists reported that accessing suitable amounts of finance through traditional lenders remained challenging, with difficult approval processes and substantial collateral requirements.

The panelists also noted that price was not the impediment. It was availability of funds.

For SMEs, opportunities to grow can be right in front of them. They need money to take them on. They need to hire more staff or buy additional machinery. To buy inventory or source raw materials. If they don’t have the money, they just can’t do it.

The RBA further noted that small businesses, “often face a number of other non-price barriers to accessing financing, arising from their smaller scale, lack of business history (at least in the earlier phases of their business) and less diversified nature. The approval process is often difficult and can be relatively costly for small businesses that do not have access to the finance teams of larger businesses. As a result, some small businesses on the panel reported that they had given up on seeking finance from banks.”

A summary of the Australian SME debt market:

Next time, we’ll look more closely at why SMEs have difficulty accessing money from traditional lenders.

A personal guarantee makes you personally responsible for the debts of the business if the business can’t pay them.

It’s a common requirement and might not be given the consideration it deserves.

Often finance companies advertise ‘no guarantees required’ but still require them for loan amounts of $100,000 or more. We see it for everything from vehicle finance to photocopier leases.

They put your personal assets directly at risk. If your accountant has advised you to establish a Pty Ltd company, a trust or other structures, a big ambition is to minimise your legal risk and the risk to your assets.

Accountants and lawyers recommend these structures, in part, because of the protections they provide to your personal assets. But those protections are eliminated if you sign a personal guarantee.

It’s important to be careful: a personal guarantee can be easily overlooked in standard finance documents.

Personal guarantees say exactly what they are. You are personally guaranteeing the payment of your business’s debt. No matter what.

Finance providers use guarantees for exactly that reason: it gives them more assets as security if something goes wrong. Your assets as well as those of your business.

As business owners, we plan for the future – we look for opportunities. Most business owners are optimistic by nature. It’s why we start businesses: to build something better, to have freedom, to grow something for our families.

Sometimes in business, the unexpected happens. We have all been through the global pandemic, we can lose a major customer or a key staff member may get sick. There are many other things that can go wrong. And if your business can’t pay, the onus falls on you.

All because you signed a personal guarantee.

If a working capital finance solution requires you to give a personal guarantee, please understand that it’s a warning sign.

At Thriver, we believe that if you’ve got a great business, you need worry-free business finance that:

To help you avoid the traps, we’ve put together this short checklist:

✅ No personal or director guarantees

✅ No security over your assets

✅ The total cost is clear

✅ You’re dealing with an advisor, not a salesperson

The right finance product doesn’t need your guarantee. Personal guarantees mean that, if your business is unable to pay its debt, you’re personally responsible for doing so.

The right finance product doesn’t need your house or private assets as security. If your business is unable to pay its debt, those assets may be sold by your financier with the proceeds being used to repay the debt .

Advertised rates often aren’t the whole story: unclear fees and other charges can quickly add to the cost. If you need to dig to work out the total cost of your finance, that’s a red flag that could be surprise costs for which you hadn’t budgeted.

Every business owner can benefit from good advice.

You need to deal with someone who understands your business and can help you select the finance product best for you.

Print out the worry-free business finance checklist below. Run it over each business finance option you consider:

If you’ve got a great business, you need worry-free business finance that:

Thriver’s invoice financing solution provides all those things.

This is a time of opportunity for many WA businesses. In winning new work, businesses can find themselves paying for products and services much quicker than their clients pay them. The faster you grow, the bigger the problem becomes. It puts severe strain on the business’s cashflow and it’s hard to grow.

Let’s use the example of a business supplying goods to their customers:

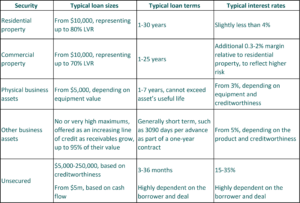

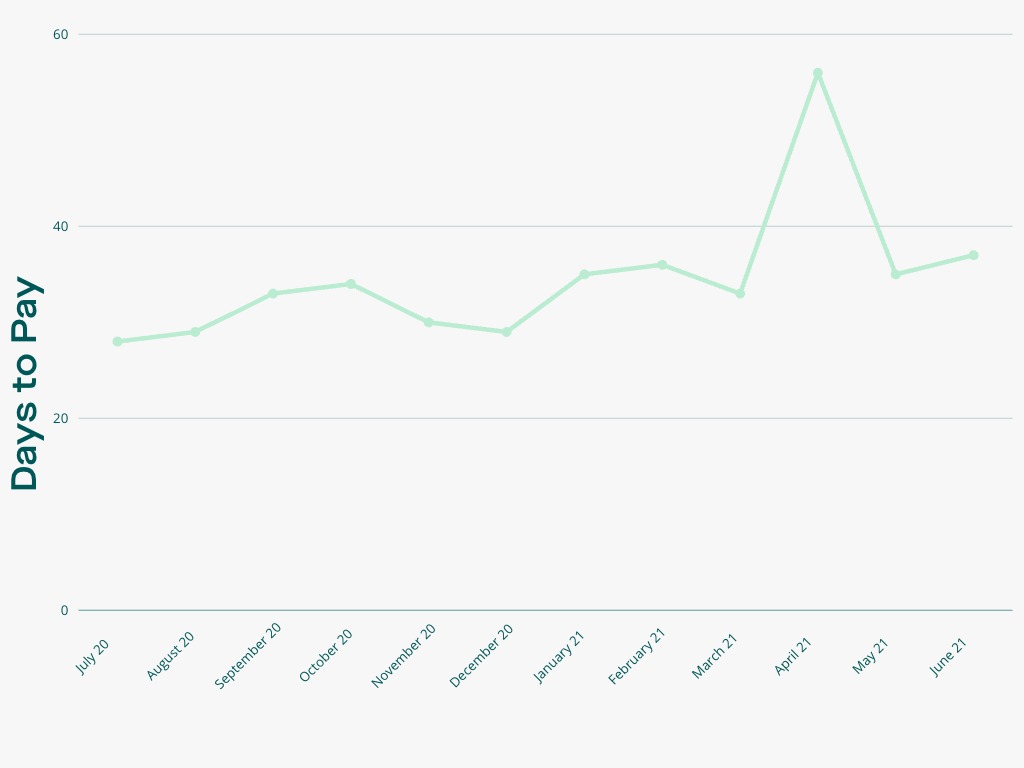

In the typical goods supply cycle, you’re paying the bulk of the costs associated with a sale well before you receive payment. You’ve got the costs of the goods, your internal labour costs and your overhead costs. You are seeing a lot of money go out before the last step – step 8 above – when your customer pays. Also, across all industries and business sizes, it is taking on average 37 days for your invoices to get paid, and that’s getting longer:

Faster growth only makes the problem worse. As you win new business, you’ve got even more money going out the door to support that new work. The capital requirements in your business will increase dramatically. Your business may grow faster than its ability to fund that growth.

For a business owner, there are business finance options available, including bank loans and overdrafts, non-bank finance and, in the worst case, delaying creditors.

One option is to make use of the assets in your business to secure a business finance solution. Often the best assets for this are your customer invoices. In invoice financing, you sell your invoices to the financier. This brings forward your cash inflows and provides working capital to fund existing and new work.

So, what’s the catch?

A traditional invoice financing facility will involve you selling all of your customer invoices, whether you want to or not. The facilities’ costs also tend to be expensive with complicated pricing. They commonly require security over all of your business’s assets and your personal guarantee.

We believe that the best business finance solution:

Thriver’s invoice financing solution provides all those things:

We work with you to understand your best quality customers and a facility limit that suits your needs. You sell only the invoices that you want to sell. When we buy an invoice, we pay you 80% of the invoice value, with the balance (net of fees) paid to you when the invoice is paid.

Thriver works with high quality businesses with strong customers. Because of that, we don’t need additional security from your business or from you. We price our facilities fairly and transparently, meaning that you always know the cost of your financing and can build that into your cash flows.

In the midst of Covid in 2020, WA’s economy contracted just 0.2% as many advanced economies contracted by more than 10%. The WA Government forecast the economy to grow 2.0% in the last financial year and a further 2.75% this year. A number of commentators have put that expected growth closer to 5%, along with a record budget surplus driven by iron ore and other mineral royalty payments. With borders effectively closed to foreign workers, the unemployment rate has fallen below 5% and job vacancies, skills shortages and some wages are rising.

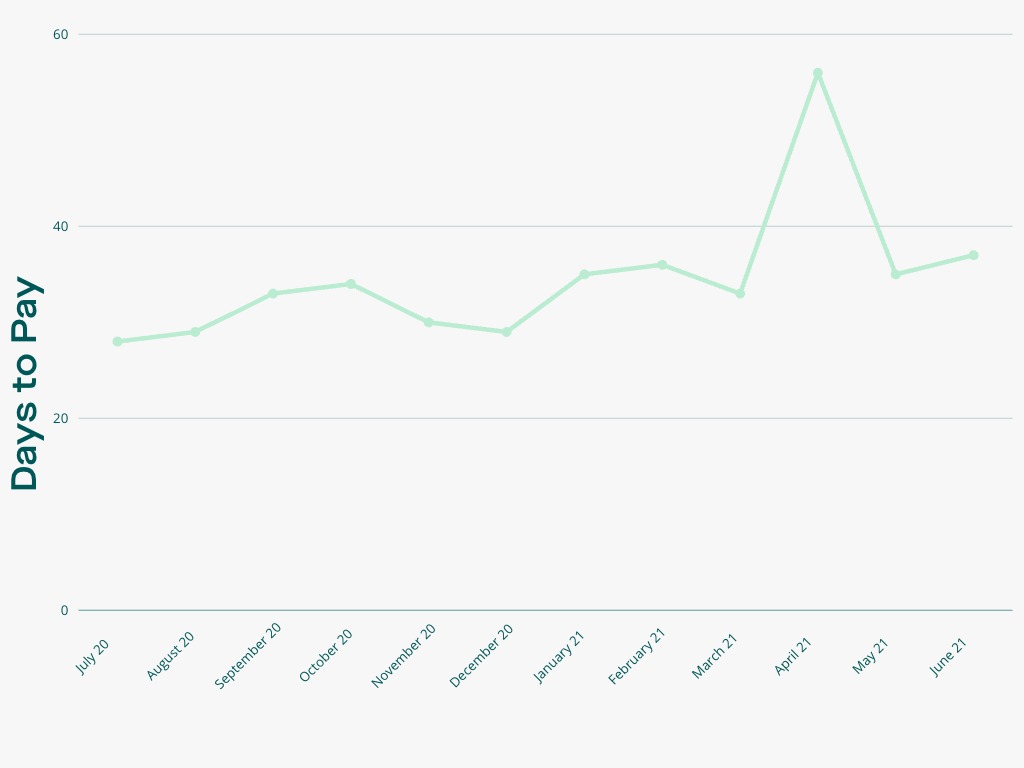

The Department of Mines, Industry and Regulation says, at September 2020, there were resources projects in the development pipeline valued at $129 billion with $28 billion already under construction or committed. This followed $19 billion of investment in the mining sector in 2019-20, a record since the LNG boom in 2012-13:

For many WA businesses, this is a time of opportunity. CCIWA’ Business Confidence Survey has shown confidence in the three-month outlook to be at the highest level since 2007. The Survey found 88% of businesses in the resources sector anticipate stronger economic conditions in the July quarter.

But in that opportunity, there is a major challenge. As businesses – particularly SMEs – win new work, their working capital needs grow. Business owners have to fund the costs associated with that additional work and often the requirement outstrips both cash flow and capital reserves.

Across all industries and business sizes, it is taking longer for companies to pay their suppliers. Even excluding the Covid-related anomaly in April 2021, the trend is established. It will take on average 37 days for your invoices to get paid, and that’s getting longer.

When you combine opportunities for high growth with slower payment times, SMEs are being put in a capital squeeze and not being able to fund their growth.

Suppliers, staff and the ATO all need to be paid. Staff and suppliers in particular need to be paid before clients pay their invoices. This creates an ‘upside down’ cash flow cycle, with businesses in a perpetual cycle of outgoing cash flow.

As a business owner, there are some traditional business finance options open to you. In whole or part, they can help fund your business as it grows.

None of these options are appealing, they can also be very expensive and put your personal assets at risk.

As businesses – particularly SMEs – win new work, their working capital needs grow. Business owners have to fund the costs associated with that additional work and often the requirement outstrips both cash flow and capital reserves.

Many businesses have assets that can be used to secure a business finance solution.

Financing using these assets can allow your business to grow without the constraints of traditional finance options. One example is invoices owed by your clients. Another is unencumbered equipment.

The best business finance solution has the following characteristics:

Above all, a business owner should be able to work closely with their finance provider. You need a relationship with your finance provider. To have personal contact with the people making the decisions. People who don’t need to send the decision to ‘credit’ or elsewhere.