A personal guarantee makes you personally responsible for the debts of the business if the business can’t pay them.

It’s a common requirement and might not be given the consideration it deserves.

Often finance companies advertise ‘no guarantees required’ but still require them for loan amounts of $100,000 or more. We see it for everything from vehicle finance to photocopier leases.

They put your personal assets directly at risk. If your accountant has advised you to establish a Pty Ltd company, a trust or other structures, a big ambition is to minimise your legal risk and the risk to your assets.

Accountants and lawyers recommend these structures, in part, because of the protections they provide to your personal assets. But those protections are eliminated if you sign a personal guarantee.

It’s important to be careful: a personal guarantee can be easily overlooked in standard finance documents.

Personal guarantees say exactly what they are. You are personally guaranteeing the payment of your business’s debt. No matter what.

Finance providers use guarantees for exactly that reason: it gives them more assets as security if something goes wrong. Your assets as well as those of your business.

As business owners, we plan for the future – we look for opportunities. Most business owners are optimistic by nature. It’s why we start businesses: to build something better, to have freedom, to grow something for our families.

Sometimes in business, the unexpected happens. We have all been through the global pandemic, we can lose a major customer or a key staff member may get sick. There are many other things that can go wrong. And if your business can’t pay, the onus falls on you.

All because you signed a personal guarantee.

If a working capital finance solution requires you to give a personal guarantee, please understand that it’s a warning sign.

At Thriver, we believe that if you’ve got a great business, you need worry-free business finance that:

To help you avoid the traps, we’ve put together this short checklist:

✅ No personal or director guarantees

✅ No security over your assets

✅ The total cost is clear

✅ You’re dealing with an advisor, not a salesperson

The right finance product doesn’t need your guarantee. Personal guarantees mean that, if your business is unable to pay its debt, you’re personally responsible for doing so.

The right finance product doesn’t need your house or private assets as security. If your business is unable to pay its debt, those assets may be sold by your financier with the proceeds being used to repay the debt .

Advertised rates often aren’t the whole story: unclear fees and other charges can quickly add to the cost. If you need to dig to work out the total cost of your finance, that’s a red flag that could be surprise costs for which you hadn’t budgeted.

Every business owner can benefit from good advice.

You need to deal with someone who understands your business and can help you select the finance product best for you.

Print out the worry-free business finance checklist below. Run it over each business finance option you consider:

If you’ve got a great business, you need worry-free business finance that:

Thriver’s invoice financing solution provides all those things.

This is a time of opportunity for many WA businesses. In winning new work, businesses can find themselves paying for products and services much quicker than their clients pay them. The faster you grow, the bigger the problem becomes. It puts severe strain on the business’s cashflow and it’s hard to grow.

Let’s use the example of a business supplying goods to their customers:

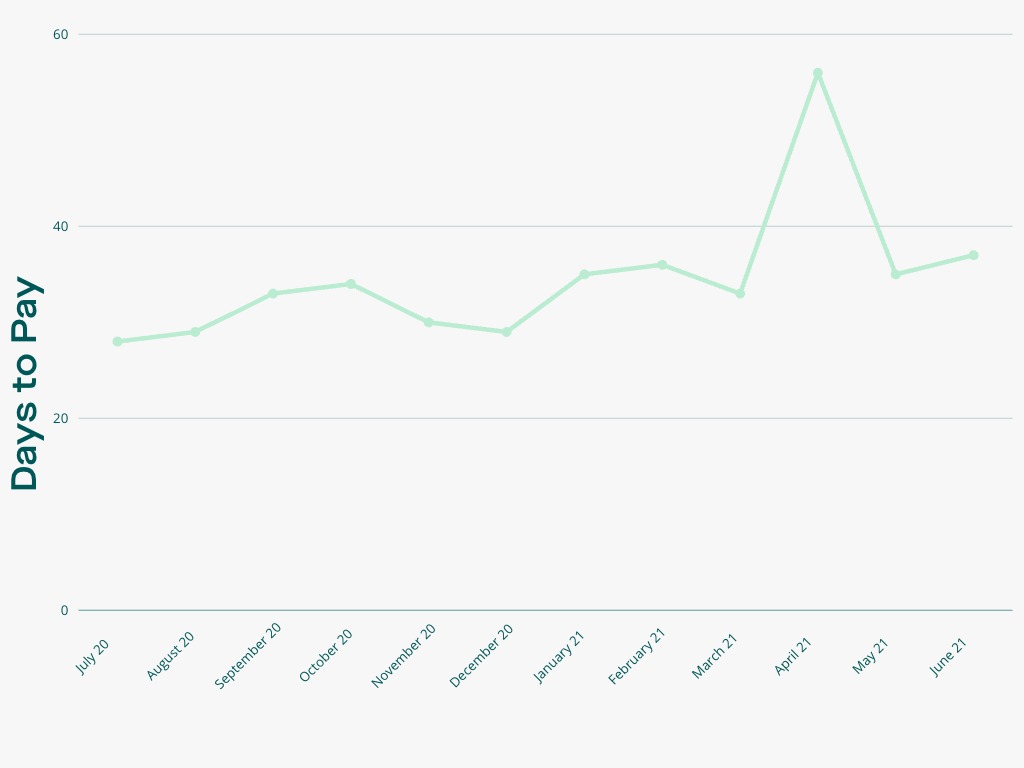

In the typical goods supply cycle, you’re paying the bulk of the costs associated with a sale well before you receive payment. You’ve got the costs of the goods, your internal labour costs and your overhead costs. You are seeing a lot of money go out before the last step – step 8 above – when your customer pays. Also, across all industries and business sizes, it is taking on average 37 days for your invoices to get paid, and that’s getting longer:

Faster growth only makes the problem worse. As you win new business, you’ve got even more money going out the door to support that new work. The capital requirements in your business will increase dramatically. Your business may grow faster than its ability to fund that growth.

For a business owner, there are business finance options available, including bank loans and overdrafts, non-bank finance and, in the worst case, delaying creditors.

One option is to make use of the assets in your business to secure a business finance solution. Often the best assets for this are your customer invoices. In invoice financing, you sell your invoices to the financier. This brings forward your cash inflows and provides working capital to fund existing and new work.

So, what’s the catch?

A traditional invoice financing facility will involve you selling all of your customer invoices, whether you want to or not. The facilities’ costs also tend to be expensive with complicated pricing. They commonly require security over all of your business’s assets and your personal guarantee.

We believe that the best business finance solution:

Thriver’s invoice financing solution provides all those things:

We work with you to understand your best quality customers and a facility limit that suits your needs. You sell only the invoices that you want to sell. When we buy an invoice, we pay you 80% of the invoice value, with the balance (net of fees) paid to you when the invoice is paid.

Thriver works with high quality businesses with strong customers. Because of that, we don’t need additional security from your business or from you. We price our facilities fairly and transparently, meaning that you always know the cost of your financing and can build that into your cash flows.